Some of the most complex engineering done today revolves around the aerospace industry. Keeping a plane, satellite, or rocket airborne is a challenge involving thousands of variables, all of which keep changing during the course of operations. The equipment needs to be robust and capable of maintaining accurate, predictable performance over a long period of time. In addition to this, efficiency calls for the need to keep things light-weight.

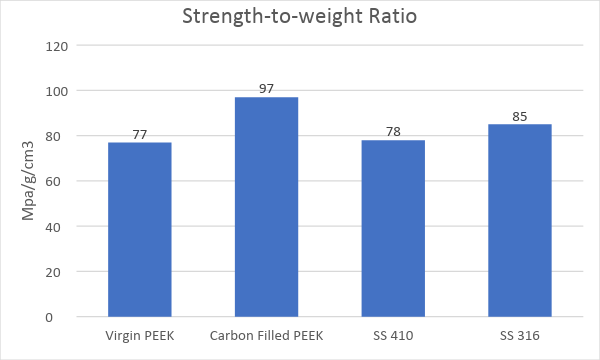

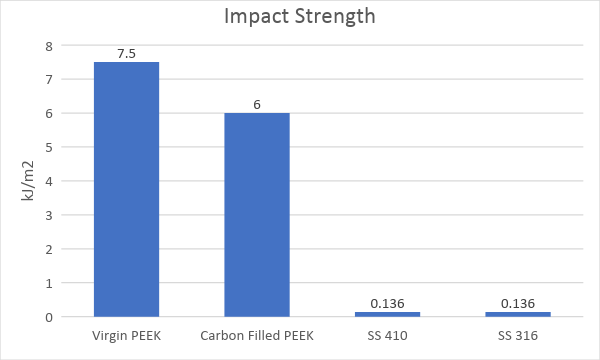

This demanding combination of low-weight and high-strength has led to the invention of some of the most exceptional materials in recent times. Polymers such as PEEK and Polyimides have been used with reinforcement to offer metal-like levels of tensile properties, while reducing the weight by as much as 85%.

Among the most useful such materials is expanded PTFE (ePTFE).

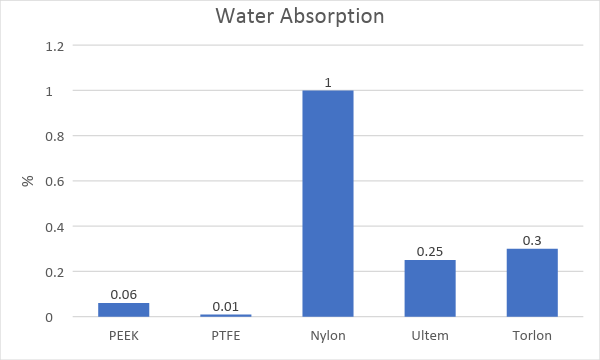

While PTFE alone is a useful polymer in aerospace – finding applications in radar (radomes), fluid transfer (tubes, bobbins), and insulation (tapes, films) – expanded PTFE offers a range of new properties that augment the usefulness of this material further.

We look here at some of the areas of application of ePTFE tapes within the aerospace domain:

- Sealing function

ePTFE has a soft, foam-like structure that easily adopts the shape of the material around it. As such, it can be sandwiched between any two harder elements to create a perfect seal instantly. ePTFE is so pliable that the seal can be created with minimal torque. The seal is able to perform even at high-pressures, meaning there is little risk that a good seal at ground level, will suddenly fail when pressures start increasing.

In addition to the seal-ability of the material, it is also resistant to both high and low temperatures (-250°C to +250°C) and chemically inert. Again – the idea that the seal will cease to perform at extreme environmental conditions is completely mitigated.

ePTFE tapes are usually used in areas where a permanent seal is needed and where the assembly is not likely to be disturbed frequently. It is a vital part of both build and maintenance operations since it is available as a roll and can be very easily used on-site. - Anti-squeak / anti-chafe function

Another frequent problem with aerospace is that even with the most modern design techniques, it is impossible to fully predict which components will vibrate during operation. Vibrating parts can rub against one another causing wear outs and noise. Expanded PTFE tapes are an ideal medium to use between rubbing parts. Not only does the tape squeeze down to accommodate the exact gap between the parts, but it’s low coefficient of friction eliminates any damage that the parts can do to one another and any noise that might be created.

ePTFE is also light-weight (the density can be as low as 0.35g/cm3), so it can be used without any worry that you would be adding load to the system. - Anti-corrosion function

In areas with heavy exposure to fuels and aviation oils, ePTFE can be used as an effective protector. Being oleophobic, ePTFE repel oils and can therefore form an effective layer over areas that would otherwise be corroded by repeated contact with oils and fuels that may splash on to it.

The material is particularly useful in access panels and fairings where hydraulic or engine oil contamination could occur.

Apart from the areas cited about, ePTFE finds plenty of uses across both the maintenance and manufacture of the equipment. Its unique properties combine seal-ability, temperature and chemical resistance, abrasion resistance and a high strength-to-weight ratio, making it one of the most versatile materials to be used in the field of aerospace.