It doesn’t require a scientist or an engineer to take a basic property of a material and extrapolate the possible areas of application.

We have spent the last one year developing ePTFE membranes, as we saw it as a key growth area within the PTFEspace. As a technology, it remains obscure. Yet the demand for this product is so vast that it is no wonder that the few companies that have perfected it have been able to command the market (and by extension, the price).

To say that we have perfected ePTFE membranes would still be an overstatement. Being an SME, we have had to focus our R&D in those areas where clients have shown interest, rather than take a broader approach and simultaneously develop multiple variants. However, in our pursuit of client satisfaction, there have been consistent findings that have slowly allowed us to start tapping into the broader demand in the market. In addition to this, what we know about the property of the material gives us insights into other, perhaps less explored areas of application.

To start with, let us lay out the most fundamental property of this material:

ePTFE membranes allow gases and vapours to pass, while restricting liquids

This ability is what lays the foundation for the myriad applications (and potential applications) of ePTFE membranes. When coupled with the other properties of PTFE – such as temperature resistance, chemical inertness and dielectric strength – it is easy to see why the product is so much in demand.

- ePTFE Membranes in Automotive Vent ApplicationsAuto is a well traversed industry for ePTFE usage. We started our development of ePTFE membranes when we were asked to replicate an automotive vent as manufactured by Gore. The vent is a small disk of ePTFE membrane, with an adhesive backing. We were able to develop it in both virgin form and with a carbon filling.

The purpose of this vent is to sit on a small opening at the back of the headlamp chamber. Any moisture that could potentially fog the headlights and/or condense within the chamber is released via the vent. However, as the vent is only permeable to gases and not liquids, water is no allowed back into the headlamp chamber, keeping it free from moisture.

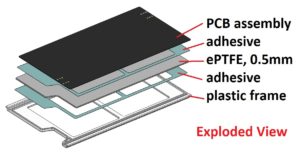

- ePTFE Membranes in PCB applicationsThe effect of moisture on PCBs is well known. Apart from rust and corrosion, the presence of excess moisture can cause multiple short circuits, destroying the device within which the PCB is operating.

ePTFE membranes are ideal in allowing any moisture built up within the PCB assembly to escape. At the same time, in the event of direct exposure to liquids, the ePTFE membrane shields the PCB, keeping it dry.

The usefulness of this application is seen in nearly every industry where electronics are used. With mobility becoming more important, the chance of exposing a device to moisture becomes nearly unavoidable (think, dropping your smartphone into water). Having the protection of a breathable ePTFE membrane means the device is less likely to fail in such an event.

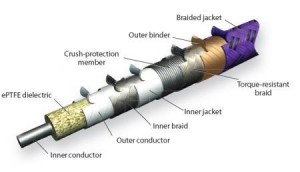

- ePTFE Membranes in Cable WrappingWe have covered this in an earlier post. However, it is useful to reiterate that the high dielectric capabilities of ePTFE drive its use as a cable wrapping medium.

ePTFE insulator tape can be made with tightly controlled thicknesses of as little as 0.05mm, with a uniform density, and dielectric constant. Wrapping individual conductors in ePTFE can cut interference, noise, cross-talk, and signal attenuation. In some applications, ePTFE tape helps limit phase shift to 4.3° and signal attenuation to 0.05 dB at 110 GHz.

- ePTFE Membranes in FiltrationMultiple applications within filtration exist for the use of ePTFE. Filtration itself requires different levels of porosity and pore size and the membrane needs to be customised accordingly.

One of the most commonly known filters is used in vacuum pumps. It consists of a single ePTFE layer, moulded into a polypropylene housing (see below).

- ePTFE Membranes in DesalinationWe believe this may be a huge growth area going forward. Desalination is an expensive process currently. An ePTFE layer could be used to allow for evaporated vapours from a salt water reservoir to pass through it and into an upper chamber. Consequently, it would prevent the condensed liquid from re-entering the salt water reservoir. In this manner, the water is separated from the salt using only solar energy. Spread over a wide enough area, this could effectively trap evaporating sea water to convert to fresh water.

We expect to continue adding to this list as more uses of ePTFE membrane become apparent. One thing we do know is that is a material of the future and that being able to modify and customise its texture and form would be a key proprietary skill going forward.